How does CFD trading work?

A contract for difference (CFD) is a type of trading that enables traders in United Kingdom to speculate on asset price movements. British involved can take either a long position (the asset price will go up) or a short position (the asset price will go down) when purchasing CFDs. When the contract expires, the trader is paid the difference in the case of a correct speculation, or must pay the difference in the case of an incorrect speculation.

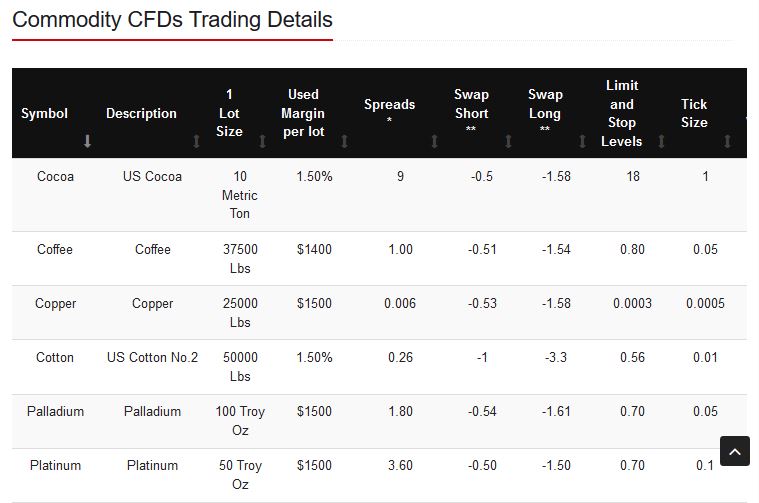

CFDs are a popular method of trading Forex, commodities, and stocks in UK. Many operators that sell CFDs will allow the trader to use leverage; with some as high as 1:1000. This means that traders might make significant wins or losses with a relatively low investment.

CFD Brokers

CFD Brokers